We are currently receiving more inquiries on our website on this topic than any other, so I want to highlight some of the specific benefits to calling Florida your primary residence.

But first, I would be remiss if I didn’t touch on our Sarasota real estate market here in mid-August:

- The market is still highly active with the best properties still being purchased in days.

- There is not quite the frenzy that there was 2-3 months ago. However, I would not say that our market has “slowed-down.” There is still a tremendous amount of activity.

Florida Taxes and Their Implications

While taxes are not the most exciting topic, having your primary residence in Florida could save you a lot of money. I have been advised to let you know that I am not a tax expert- please consult with an expert that is familiar with your situation. I provide the names for two outstanding local professionals below should you need a recommendation.

TOP 6 Florida Tax Facts:

- There is no state income, estate, or gift tax in Florida.

- Homestead exemption, which is available on your primary residence, reduces your assessed property values up to $50,000. It also limits annual increases (of your assessed value) to 3% or less.

- If you sell your primary residence (where you have lived for 2 of the last 5 years); there is a $250,000 exclusion of the gain if single or MFS (married filing separately) and $500,000 exclusion of the gain if MFT (married filing together). There are exceptions and special situations so consult your CPA.

- Rental Income is taxed at ordinary income rates. There are also exceptions.

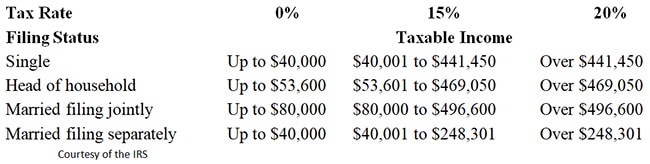

- Capital Gains rates depend on your income bracket. The highest rate is 20% and the lowest rate is either 0% or 15%. For a select few there is NIIT (Net Investment Income Tax).

Read more about the benefits of being a “Snow Bird:” Sarasota’s Most Populous Bird Brings Millions to the Economy.

2020 Long-Term Capital Gains Tax Rates

Living in Sarasota continues to be beautiful, vibrant and can save you a lot of money. For great advice in these topics, you can reach out to Liz Cottom, a board-certified wills, trust, and estate attorney at Williams Parker, and Shelly Parmet-Evans, a CPA at Piper Hawkins.

We are here to expertly guide you on your real estate needs when you are ready. Feel free to give us a call @ 941.587.0740.